Trading Platforms

What Is Trading?

Financial trading is no different than any other type of trading in that it involves the purchase and sale of assets with the goal of profit. Learn about the key concepts, players, and markets involved in financial trading.

What Exactly Is Trading?

Trading is the purchase and sale of financial instruments for profit. These instruments are made up of a variety of assets that have a financial value that fluctuates – and you can trade on the direction they take.

You’ve probably heard of stocks, shares, and mutual funds. However, there are thousands of financial markets to trade and a wide range of products to trade them with.

You can gain exposure to markets such as the S&P 500, the FTSE 100, global currencies such as the US dollar or the Japanese yen, and even commodities such as lean hog or cattle.

To get started, you’ll need to sign up for a platform that offers these markets. Our online trading platform includes a number of financial markets that allow you to speculate on whether an asset’s price will rise or fall. In addition, we’ve put together a trading for beginners guide to help you get acquainted with the various markets.

What Assets & Markets Are Available For Trading?

Investing vs. Trading

The distinction between trading and investing is based on how you make a profit and whether you own the asset. Traders profit by buying low and selling high (going long) or selling high and buying low (going short) in the short or medium term. They do not own the asset with which they trade.

Investors want to buy shares at a low price and own the company outright. They profit by holding the stock and then selling it at a higher price. The hope is that the share price will rise in the long run, allowing them to profit from the movement. Dividends may also be paid to investors if the company declares them. They will also have voting rights as shareholders.

amount in 2019.1, 2 These figures soared after coronavirus-related volatility hit the market and stock prices fluctuated at an unprecedented rate.

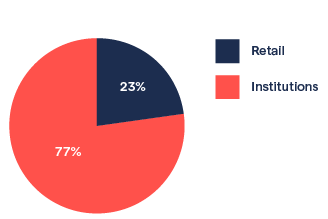

Some financial traders and investors focus on a single instrument or asset class, whereas others maintain a more diverse portfolio. Governments and institutions can adapt much more quickly because they frequently have departments dedicated to trading different sectors and industries. Institutions continue to be the most active market participants, accounting for 77% of all trades.

Individuals who want to invest in the stock market must go through a stockbroker who will execute the order. They’ll do their homework, research before making a trade, read charts, and research trends, and the broker will act on their behalf. They trade from their own private accounts, which they fund and are fully responsible for losing.

Commercial banks, hedge funds, and corporations that trade and invest have an impact on the liquidity and volatility of the market’s stocks. This is due to the fact that they typically engage in block trades, which involve buying or selling at least 10,000 shares at a time.

How We Guide You In Online Trading?

www.metapayclicks.com is providing you with highly supportive educational and online business sector of trading in the stage of Online Money Making. The beauty of this website is that you don’t need any prior experience or knowledge of the trading industry. However, you must have a strong desire to succeed as a business owner in this industry. We will assist you in easily winning the cup. We provide all educational and trusted trading platforms.

Begin today by becoming a subscriber to our website, which will open the door to your success story.